CRA Online Mail: The 2025 Setup That's Saving Canadians Hours And Money

- Dayna Dumont

- Jul 29, 2025

- 5 min read

Remember when you checked your mailbox every day, hoping your tax papers would finally show up? Or that awful feeling when you thought maybe your important tax letter got lost? Those stressful days are over! CRA Online Mail is changing how people in Ontario get their tax mail – and we are SO happy about it!

Here's the cool part: you'll never have to worry about missing important tax stuff again. No more waiting for the mailman or wondering if your papers are lost somewhere. Now, you'll get everything delivered right to your computer or phone.

Understanding CRA Online Mail

CRA online mail represents a massive leap forward in how Canadians receive their tax-related mail. As of July 3, 2025, the CRA officially changed the method of delivering most mail from paper to online for about 500k benefit recipients. Instead of waiting days or weeks for paper mail that can get lost, damaged, or delayed, you'll receive immediate digital access to all your important tax documents through your My Account portal.

What's Included in Your Digital Mail:

Notice of Assessment and Reassessment

Canada Child Benefit statements and updates

GST/HST credit notifications

Old Age Security and CPP mail

Benefit payment confirmations and adjustments

Audit requests and tax review notifications

General tax-related notices and important updates

The brilliant part? Going forward, you will start receiving email notifications when new mail is available to view in My Account, giving you immediate awareness of any important notifications and eliminating the uncertainty about document delivery timing.

Your Simple Step-by-Step Setup Guide

Setting up your CRA Online Mail system is refreshingly straightforward. Most Ontario residents can complete the entire process in less than 15 minutes from the comfort of their own home, and the benefits are immediate.

What You'll Need Before Starting:

Your Social Insurance Number (SIN)

Personal information from your most recent tax return or benefit statement

A valid email address that you check regularly

Your current postal code and date of birth

Access to online banking or a phone for verification

The Quick Registration Process:

Step 1: Access Your Personal CRA Portal: Visit canada.ca/my-account and select "Register" if you don't already have an account. The interface is user-friendly and guides you through each step clearly.

Step 2: Complete Identity Verification: Enter your social insurance number, personal details from your recent tax documents, and current contact information. This security step ensures your sensitive tax and benefit information remains completely protected.

Step 3: Choose Your Authentication Method: Select from several convenient verification options:

Online Banking Partnership: Link through your existing bank login (fastest and most popular option)

CRA Mobile Verification: Use the secure mobile app verification system

Security Code by Mail: Receive a verification code within 5-10 business days

Step 4: Activate Your Digital Mail System: Once logged in, navigate to your mail preferences and confirm your digital notification settings. You can customize what types of notifications you receive and how often.

Pro Tip: Sessions automatically log out after 16 minutes of inactivity for your security, so complete each step without extended breaks.

Maximizing Your Email Alert System (This Changes Everything)

Here's where CRA Online Mail truly transforms your tax management experience: intelligent email notifications that keep you perfectly informed without overwhelming your inbox. These smart alerts ensure you never miss important messages while giving you complete control over what you receive.

Setting Up Your Personalized Notification System:

Sign into your My Account portal

Select "Manage online mail preferences" from the main menu

Choose which types of messages trigger immediate email alerts

Add a backup email address for extra security

Set your preferred notification schedule (instant, daily summary, or weekly digest)

Critical Email Configuration Step:

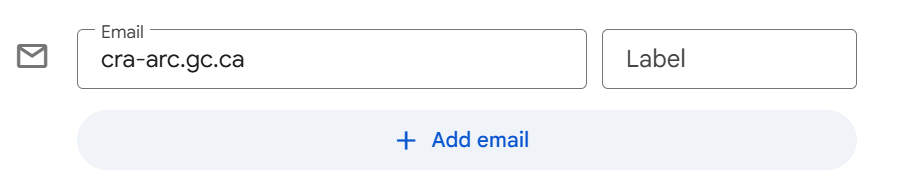

Add "cra-arc.gc.ca" to your email whitelist or trusted sender list. This essential step ensures CRA notifications reach your primary inbox instead of being filtered to spam or promotional folders – a simple action that could save you from missing time-sensitive information.

Email notifications from the CRA let you know when important changes are made on your account and when you have new mail to view in My Account. Many Ontario residents find that setting up instant alerts for benefit changes and tax assessments while choosing weekly summaries for general notifications provides the perfect balance.

Your Paper Mail Options - Because Personal Preference Matters

We understand that some individuals still prefer receiving physical copies of their important tax documents, and the CRA has made it easy to maintain this preference while still enjoying the benefits of digital access.

How to Continue Receiving Paper Mail:

If traditional mail delivery works better for your situation, you can easily maintain this option. If you prefer to receive paper mail from the CRA, you can update your mailing preference directly in your My Account:

Sign into your My Account portal

Navigate to "Profile" and select "Correspondence preferences"

Choose "Paper mail" as your preferred delivery method

Ensure your mailing address stays current to guarantee reliable delivery

The Smart Hybrid Approach:

Many Ontario residents are discovering the advantages of choosing both digital and paper delivery. This gives you immediate online access for urgent matters while maintaining physical records for your personal files. This dual approach provides the ultimate convenience – instant notifications with traditional documentation backup.

Important Considerations for Paper Mail Users:

Paper mail preferences can be updated anytime through your My Account

Address changes must be updated immediately to prevent delivery issues

Digital access remains available even with paper mail preference for emergency situations

Having an email address on file with the CRA helps protect your account from fraudulent activity and helps make sure you don't miss CRA mail, some of which can be time sensitive

Making the Most of Your Digital Tax Management

CRA Online Mail puts powerful tools directly in your hands. With instant access to important documents, customizable notifications, and secure 24/7 availability, you're better equipped than ever to manage your tax affairs efficiently.

Success with this new system comes down to taking a few minutes now to set everything up properly. Once configured, you'll wonder how you ever managed without instant access to your tax information.

This digital transformation represents more than just a change in delivery method – it's an opportunity to take greater control of your tax affairs while reducing stress and improving your response times to important CRA communications.

Ready to embrace the future of tax communication? Book an initial consultation with us today, and we'll walk you through the complete setup process while showing you how to integrate digital tax management into your personal financial planning for maximum benefit!

Comments